Raising your first round [Pt. 1]

Funding is at the top of nearly every startup founders mind. Let's look at why, when, how much and the considerations when it comes to raising your first round. Part 1 of 2.

As a startup founder, raising capital seems to be at the top of everyone’s mind in the early days. It’s often spoken about from inception and the comment “we need to raise a million” is commonly thrown around without too much consideration. The majority of startups struggle to raise their first round, let alone any rounds at all. Some do it with ease. The truth? It comes down to so many variable factors. But, the right intentions need to be there.

Startups and their founders commonly discuss how much they should raise. But should also be asking “Do we even need to raise capital at all?”.

Times are changing. Traditionally startups have been both time and capital-intensive for even the most basic of products. Research & development dominates startup budgets, and well… software engineers are expensive. But with the rate of technological progression, it has become much faster, easier, and cheaper to build software. This is thanks to the introduction of no-code/low-code tools (including AI), the growing number of development talent, global flexibility, and access to learning materials. In today’s age, you can pull together an MVP in hours, without any technical knowledge, and you can generate revenue. We call this bootstrapping.

Acquire.com is a testament to just how often this is being done. It really is incredible.

So before jumping into the fundraising journey, consider the following:

What’s your market position and opportunity?

Playing for a small slice in a highly saturated and competitive market might not require funding, whereas if you’re one of few competitors in a growing market and your competitors have funding… well, raise or get left behind.

What are your long-term vision and goals, and how will speed affect them?

The best startups are driven by bold missions, backed by a strong vision, and have crystal-clear goals. These aren’t often small; they’re nuanced, tedious, and variable. Hitting milestones is a major part of it. Funding can unlock more resources to move at greater speeds.

Can you generate revenue without investor capital?

Some things, like medical advancements, blue ocean strategies, and cutting-edge technology simply require upfront capital injections; There aren’t other ways to do it. Others can generate revenue without a product. Ask yourself, “Do I need capital to generate $1, $1,000, $100,000, or $1,000,000?” if the answer is ‘no’ or ‘it depends’, then you can likely bootstrap.

What is your capacity?

A big one. I see lots of founders who have established businesses (that they’re still very much in) trying to build startups, get funding, and grow. Startups require hard work for long periods of time, so ask yourself if your capacity allows that. Be honest. You don’t want to take on investor capital to plant the seed, but not be able to water it.

P.S. Hiring an operator won’t fix that problem (early on).

What do you want to achieve?

Finally, what do you want out of it? Passive income? Fund your lifestyle? A cheque for the next? Startups are designed for liquidity events–an exit in the form of an acquisition or an IPO. Are you prepared to sacrifice short-term earnings for long-term gain?

Remember, fundraising is an activity that will actively take time away from working on your startup. Is this something you really need to do?

This is a 2 part post. In this post you’ll find my lessons, learnings and relevant industry research when it comes to looking at when you should raise your first round and how much. The second post will cover what you need, choosing investors and the process. The information has been derived from what I learnt raising a $1.15m seed round, helping other startups raise $5m, as well as other comprehensive industry research.

Let’s get into it.

What is seed funding?

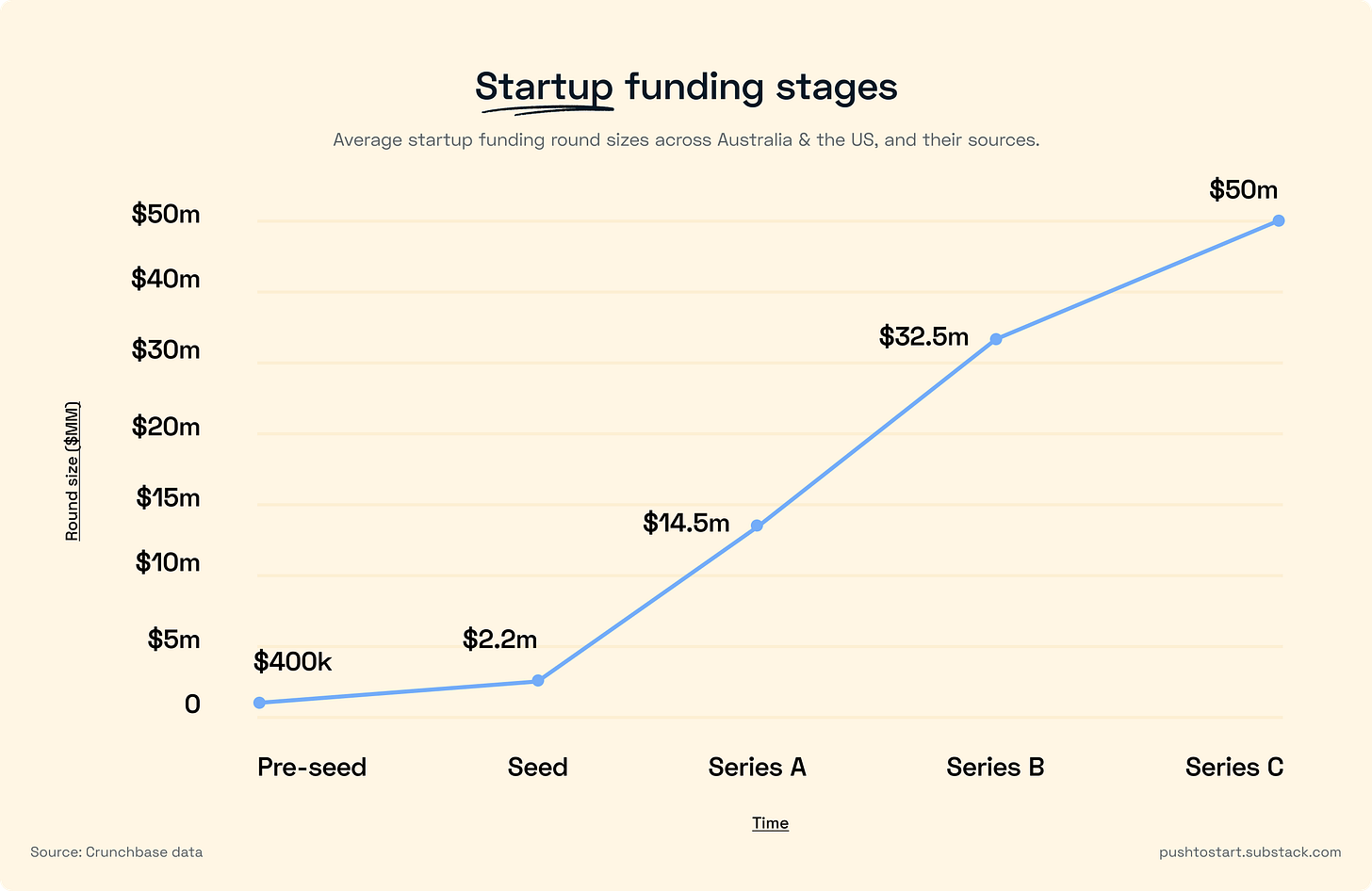

You may already know this, but I’m going to briefly touch on it just in case. In startups, there are a number of ‘rounds’. These are known formerly as pre-seed, seed, series A, B, C, and so on, with ‘bridging rounds’ in between these… sometimes. Even though they have formal names and periods, they’re quite loose. Most of the time they’re categorized into seed (pre-seed and seed) and growth (series A+) rounds.

Seed funding is simply defined as the initial round of capital raised by startups from private investors to fund the early development of the business.

It’s incredibly risky, but if investors get it right it’s also incredibly rewarding 🤑.

When to raise your first round?

Now, there are a number of factors to consider when looking to raise your first round, including how you're going to raise, how much you're looking for, and what you are actually raising for. These pieces will determine when you should raise your first round. We’ll get to them. But first, let’s see what the data says.

Over the last 10 years, there have been 63,584 seed (including pre-seed) startup funding rounds across Australia and the United States. Keep in mind that I only included active companies, and there will be more if you include dead startups. I also chose 10 years as the data from the last 5 years has a bias from the 2021 startup boom which saw inflated valuations that were closed quickly on unrealistic terms.

Across those sixty-odd thousand startups, there was an average of just over 27 months between their founding date and raising their first round. In other words, they worked for an average of 2 years before closing their first funding round. The takeaway? Don’t expect to have an idea → raise capital. We’ll get to what you need to achieve before raising your first shortly

I included the data from several notable unicorns–Immutable, Canva, AirWallex, Go1, Uber, Stripe, and Instacart. Compared to the time in which startups raise their first round on average, all of these unicorns raised money faster than your average. Sometimes within months. Why? Well, I’m not sure. It could be a conviction on PMF, liquidation preferences, or any one of many things. The takeaway? you gotta’ go fast.

As a general rule of thumb, you should aim to raise a seed round within 12 months of inception.

“Stop being patient and start asking yourself, how do I accomplish my 10-year plan in 6 months? You’ll probably fail but you’ll be a lot further along than the person who simply accepted it was going to take 10 years.”

Or use this Elon Musk quote as fuel and try to do it in 2 months. You do you.

Key considerations 🔑

You understand the market opportunity

Before raising, you must have a good grip on your market opportunity (TAM, SAM & SOM), as well as some expectations of business model and revenue projects. At the pre-revenue stage, this is a critical component of investor buy-in.

You understand who your customer is

‘Everyone’ or ‘anyone that will buy are not satisfactory answers. To have an understanding of the opportunity in front of you, you must understand the customer you’re trying to target: who they are, where to find them, how they operate, and what they care about. Get specific–within the mining sector alone, there are hundreds (if not thousands) of different customer types which will ultimately differentiate buying behaviors.

You have an MVP of some sort

While you certainly can raise pre-product, it’s extremely difficult to do this without a prior founder win under your belt. In any other case, you need to have something to represent your opportunity and bring in investors and customers.

You have a level of initial traction

Don’t focus on what you hear in the media about huge rounds for conceptual products. You absolutely must be able to show some level of traction when it comes to raising your first round. This could be committed or paying customers or impressive usage or retention. If not for your investors… but for yourself as well.

You have made a dollar (closed or committed)

Now, sometimes this is not always relevant. It ties into the point above, but if at all possible, you should have proven your business model in some way, shape, or form. Undeniable evidence: paying customers.

How much should you raise?

The short answer. Only as much as you need. The long answer. Well, there are several factors to consider when determining how much you need to raise, and what valuation.

Looking at the data again, the average amount raised at seed stage is about $2.2m, whereas that number across the unicorns is about $2.5m. Again, the majority are above average. Take from that as you please, but it’s clear you should be aiming around the $2m+ mark to have a solid crack at it.

Key considerations 🔑

Your seed valuation can make or break you

Unless you’ve raised before, founders never give this much thought. Because having a juicy valuation seems appealing right? But raising on too high of or too low of a valuation can be detrimental to the success of your startup–especially at seed stage. If your valuation is too high, then it can be extremely difficult to grow into the valuation from a performance perspective. In which could make it impossible to raise a subsequent round, or attract a ‘down round’–which can be a nail in the coffin. Whereas raising at too low of a valuation can throw off equity distribution and affect later rounds as well. Letting go of too much too early, when much more is required.

Raising too much capital is a death wish

Not only does having an abundance of capital make you fat, bloated, and slow, but it also puts you in a tough position for subsequent raises because of the valuation points listed above. Capital = time, and time is not on any startup’s side, regardless of how much ‘runway’ you may have.

Not all capital is created equal

Beware of taking capital from friends/family who are in it for the wrong reasons, 3rd tier accelerators that offer no value, or venture funds that only ‘co-invest’. This type of capital can be quite ‘costly’ when it comes to time and effort. All in all, you want to make sure you’re taking capital from investors who are in it for the right reasons–having a diversified strategy and offering value without being in your business.

Be extremely conservative with forecasts

I see founders have crazy forecasts with huge numbers in the first year because of the scalability opportunities their model presents. Unless you’ve done this before, you’re going to be figuring a lot out on the fly. This takes time. You also have to account for buyer/brand hesitancy, ramp-up time, sales cycles, etc. Whatever forecasts you decide to present to investors, just make sure they’re achievable. Then give yourself more wiggle room.

Having no plan is a bad plan

Even though seed-stage plans rarely go to plan, you still need to put pen to paper in terms of how you’ll spend the capital down to the dollar. Remember to be conservative and give yourself healthy buffers.

Optimise for 18 → 24 months of runway

When raising at seed, you’re looking at how long you can survive before generating any substantial revenue, breaking even (or default alive), or turning a profit. Whilst you don’t want to raise too much capital (or too little), a general rule of thumb is to aim for 24 months or 18 months minimum.

Read more…

This was part 1 of a 2 part post. Check out ‘Raising your first round [Pt. 2]’ for more practical advice when it comes to expectations and processes.

If you enjoyed this or learned something, then please subscribe. If you know anybody that would get value from it, then please share. Your support goes a long way in helping me arm the next generation of founders with the tools to win.

How was this post?

Reply to this email with one of the following:

🔥 – I loved it!!

👍 – Good, not great

👎 – Could be better (let me know in your email)

For the love of startups,

Tim