Mastering Your Market: Invaluable Lessons For Startups

Knowing what goes on in your market is vital to the success of your startup. Let's go over an introduction to market basics, considerations and market-related lessons when building your startup.

As I’m writing this post, I’m reflecting on all the market-related mistakes I’ve made. It’s safe to say I’ve nearly made all of them, because well… I thought I could beat it. I ignored signals, focused on anomalies, curated data points in favor of my argument, and looked for every excuse under the sun.

When it’s you vs. the market, the market will win 100% of the time. Learn that. Quickly.

Picture this.

You’ve got a big idea that strives to disrupt everything. You’ve built your product. You’ve launched. You’re getting some usage and great feedback. You’re now looking to raise millions to change the world. You’re adamant that it will.

Sound familiar? It’s the same process that millions of founders have been through.

So what’s between you, and achieving that?

Survival. Growth. Larger market forces.

As an under-resourced startup, you can’t change the world in a market where no one is buying. You simply won’t survive, and survival is the key to long-term, widespread disruption.

So, Just How Important Is Market?

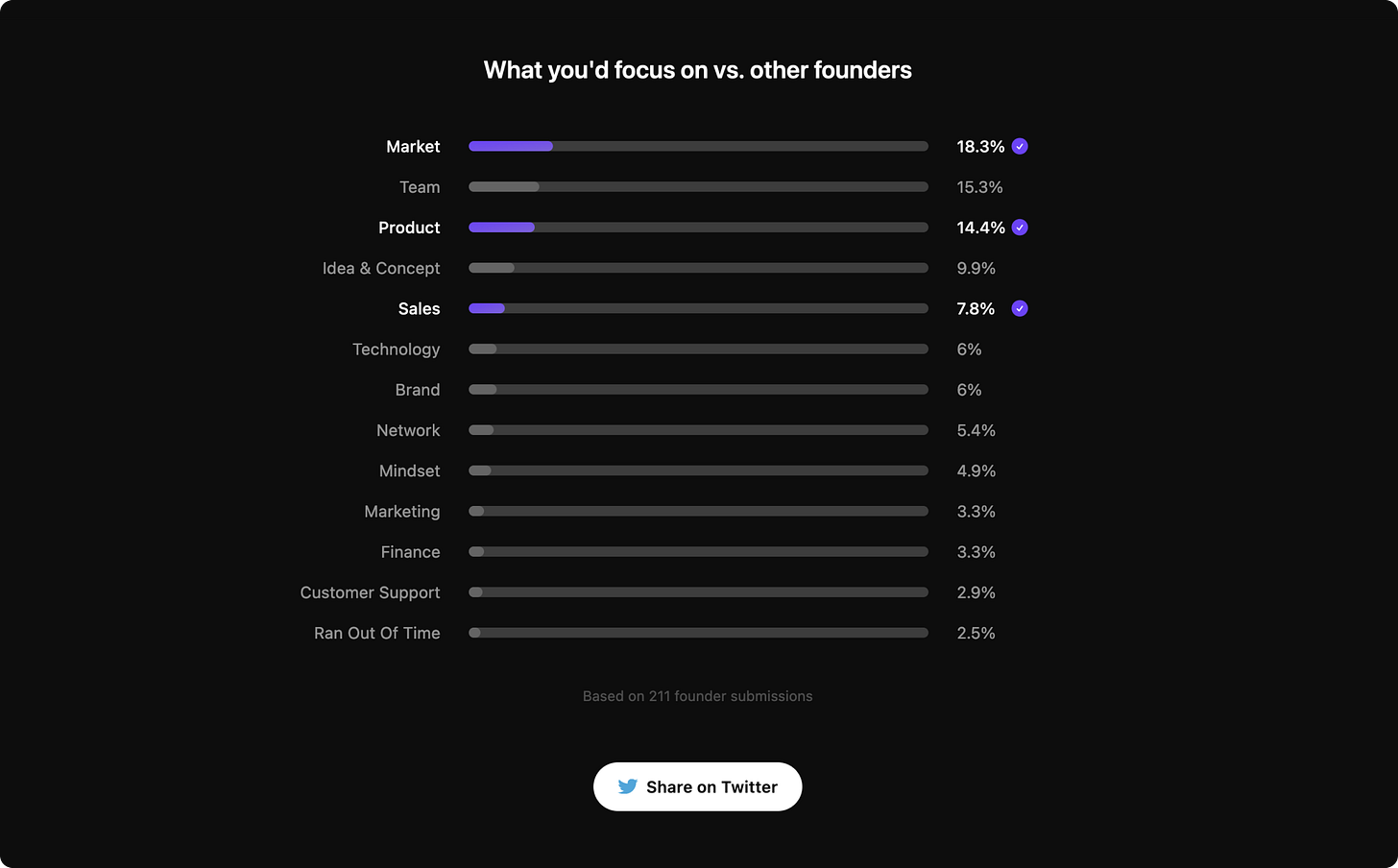

I asked 211 startup founders what their top focuses were when going from $0 to $1,000,000 ARR.

The single most important focus area? See for yourself 👇

It makes sense right? Why would you build something in a drowning market?

Well, that’s just what founders/entrepreneurs do – we tend to look for things that we can improve upon, focus on passion areas, or seek out areas to innovate, rather than areas to make the most money.

It’s usually idea first ➡️ market consideration second… and by that time, you’re already emotionally invested, so it’s full steam ahead.

It also doesn’t help that the best markets are traditionally the most boring ones.

As an entrepreneur, you don’t want to:

❌ Open a telecom carrier competitor (Largest global market),

❌ Create oil & gas software (Second largest global market),

❌ Offer an alternative life insurance product (Third largest global market), or

❌ Build tools for pension fund managers (Fourth largest global market).

[Source]

But those are the top 4 largest global markets. Instead, you want to:

✅ Invent a new way to pay,

✅ Create new ways for people to interact online,

✅ Build the future of developer tooling, or

✅ Create a platform to help the majority to make money easily.

I’m not saying you should play in the largest markets. More so, insinuating that the market is an afterthought. There are plenty more considerations when choosing or analysing your market. We’ll get to them.

In my experience, I’ve found that entrepreneurs’ desire to change the world generally runs deeper than wealth generation, and survivor bias shows us a needle in the haystack when it comes to success.

I generally hear pitches that start with “we’re building” the “Airbnb of”, the “Tinder of”, or the “Facebook of”. But so many don’t have markets to justify that scale.

What Is A ‘Market’, And Why Does It Matter?

Put as simply as possible, your market is the group of people or businesses that would potentially buy what you're selling, which is typically made up of multiple layers. Steven G. Blank identifies the four types of markets, which are:

Existing markets

New markets

A segment of existing markets as a low-cost player (a sub-category of an existing market)

A segment of existing markets with a niche strategy (a sub-category of an existing market)

Within these, your market is made up of a number of moving parts which can and will affect its size and opportunity. These are:

Industry

Geographic location

Competition (direct or incumbent)

Trends

Characteristics

Think of your market like an onion with many layers. Telling potential investors that your market is worth $3 trillion and you “just need to capture 1% of it” is a big fat red flag. Don’t do this.

Instead, you want to get a realistic grip on your market opportunity. This is traditionally labeled as your Total Addressable Market (TAM), your Serviceable Addressable Market (SAM), and your Serviceable Obtainable Market (SOM). Often paired with your go-to-market which is typically a niche sub-category of your SOM.

Here’s a more digestible view of your TAM, SAM, and SOM. Look at your industry as a whole, the vertical within, and then your niche within. Keep going smaller and smaller and you’ll often find your go-to-market segment.

In the example below, you might be looking to build a better streaming app for the generative AI market landscape because you’ve identified some opportunities. So your market + your go-to-market strategy might look like this 👇

Conducting Market Research

So how do you figure out your market and its opportunity? Conducting extensive market research is one of the very first things you should do when exploring an idea.

When conducting market research, you need to look at the following key considerations:

Market size – how much revenue has the market generated at a global and regional level, down to your SAM and SOM?

Economic environment – is the industry growing or declining? (known as Compound Annual Growth Rate or CAGR)

Competitors & pricing – who has market share, why, and how are they positioned?

Political & regulatory environment – are there any industry regulations or guidelines?

Customer needs – what does the customer want and need?

Technological position – what does the technological and innovation landscape look like?

Buying behaviors – how and what are customers buying on a frequent basis?

Seasonal factors – does your market have seasonal considerations?

Mostly all of the above can be found across a number of research websites, but you’ll want to also conduct qualitative research methods. This can be as simple as talking to a range of industry professionals, or a survey asking a range of questions.

Determining your market positioning

Now even if you’ve identified your market opportunity, you need to understand your position within. There are many ways to skin a cat here, and dozens of combinations you can pull out when positioning yourself in the market. This will affect your SAM and SOM. These are things like:

Your price point – are you low, mid, or high?

Your pricing model – are you…

Pre-sales?

Dynamic?

Pay per use?

Leasing?

Flat-rate?

Subscription?

Razor-blade?

Bundling?

Your pricing principle – are you value-based, cost-based, or competition-based?

Your business model – are you D2C, B2B or B2B2C?

Learn more about conducting market research through Hubspot’s startup blog.

6 Tough Lessons Learned

Throughout my pursuit to build a disruptive retail technology product and my involvement in a handful of startups, I’ve made a tonne of mistakes and learned some valuable lessons.

‘First mover advantage’ is more of a disadvantage than you may think 👎

Apple’s entire business model is built around this (post Jobs). Have you ever heard “Android has had this for years”? That’s a statement that’s been at the forefront of the Android/iOS user debate for a decade. Apple takes lessons, refines, and nails them.

Startups are fundamentally at a disadvantage to begin with – generally lesser capital, fewer resources, and a ticking time bomb. Speed is the aim of the game, and research, development, and experimentation are large parts of new market discovery. That’s a difficult combo to nail.

Doing something for the first time comes with costly lessons. Lessons that are almost free for others to acquire.

You’ll only really know your market after years of playing in it 👊

Market research is necessary and important, but it will only give you half of the picture. The other half is the nuanced lessons you’ll learn from the process of building, selling, marketing, and serving.

Priorities within markets constantly shift 🔎

Whilst you may have done your market research, and have a grip on the opportunity at hand, you need to understand that priorities constantly shift. What people bought last quarter, may be different the next. Priorities are often dictated by events (e.g. a large database breach will prioritise cybersecurity the following quarter). Keeping a pulse on priorities will help your product positioning and messaging.

Having no competitors is (often) a bad sign 🚩

When an investor asks “Who are your competitors?” and you reply with “No one”, you’re often going to get rejected nicely. No competitors often means you’re early (reference point #1), there is a lack of/too small of a market, or you haven’t done your research.

Pivots are almost guaranteed 🔀

Markets change. So should your product. When you first go to market, your holistic knowledge of it is nothing compared to being years deep. Thus, with more knowledge comes iterations and pivots as a response to what your users really want.

Growth doesn’t equal success 📈

Even if you’re product usage is growing fast, and you’re getting incredible feedback, it doesn’t mean your startup is going to be successful. Focusing on paying customers is the most important measure of success.

In conclusion, take the time to understand your market. The media loves to glorify square-jawed founders with brilliant ideas, that stick it through adversity and make a billion dollars. But, under the surface, you’ll find much more sobering stories of iteration like those in Founders at Work.

Don’t let survivorship bias dictate your path of persistence and do the work.

If you enjoyed this or learned something, then please subscribe. If you know anybody that would get value from it, then please share. Your support goes a long way in helping me arm the next generation of founders with the tools to win.

How was this post?

Reply to this email with one of the following:

🔥 – I loved it!!

👍 – Good, not great

👎 – Could be better (let me know in your email)

For the love of startups,

Tim